In this article, I am going to tell you How to Choose a Forex Broker? so if you want to know about it, then keep reading this article. Because I am going to give you complete information about it, so let’s start.

A forex broker, also known as an FX broker or forex broker, buys and sells currencies on behalf of clients while charging a commission for the service. You can also call this forex broker a ‘middleman’ who matches the currency. And sell orders from your customers to other customers.

Today’s article focuses on the same,i.e, “How to Choose a Forex Broker” The articles entail each bit of information necessary for you to know.

Let’s get started!

Table of Contents

How to Choose a Forex Broker?

You’ve decided to invest in forex, but how do you know which broker is right for you? Forex trading has become a popular way to make money from the fluctuating value of different currencies, and there are many brokers out there who will be happy to help you get started.

But how do you choose one? In this guide, we’ll walk you through choosing a forex broker or PayPal forex broker that fits your needs and goals.

What Does a Broker Do?

A forex broker acts as an intermediary between traders who want to buy or sell currency pairs on the foreign exchange market. They provide an easy way for traders to buy and sell currencies without having to deal directly with all of the technical aspects of trading. Typically, a forex broker will:

- Handle your finances

- Provide a trading platform

- Provide timely trading advice

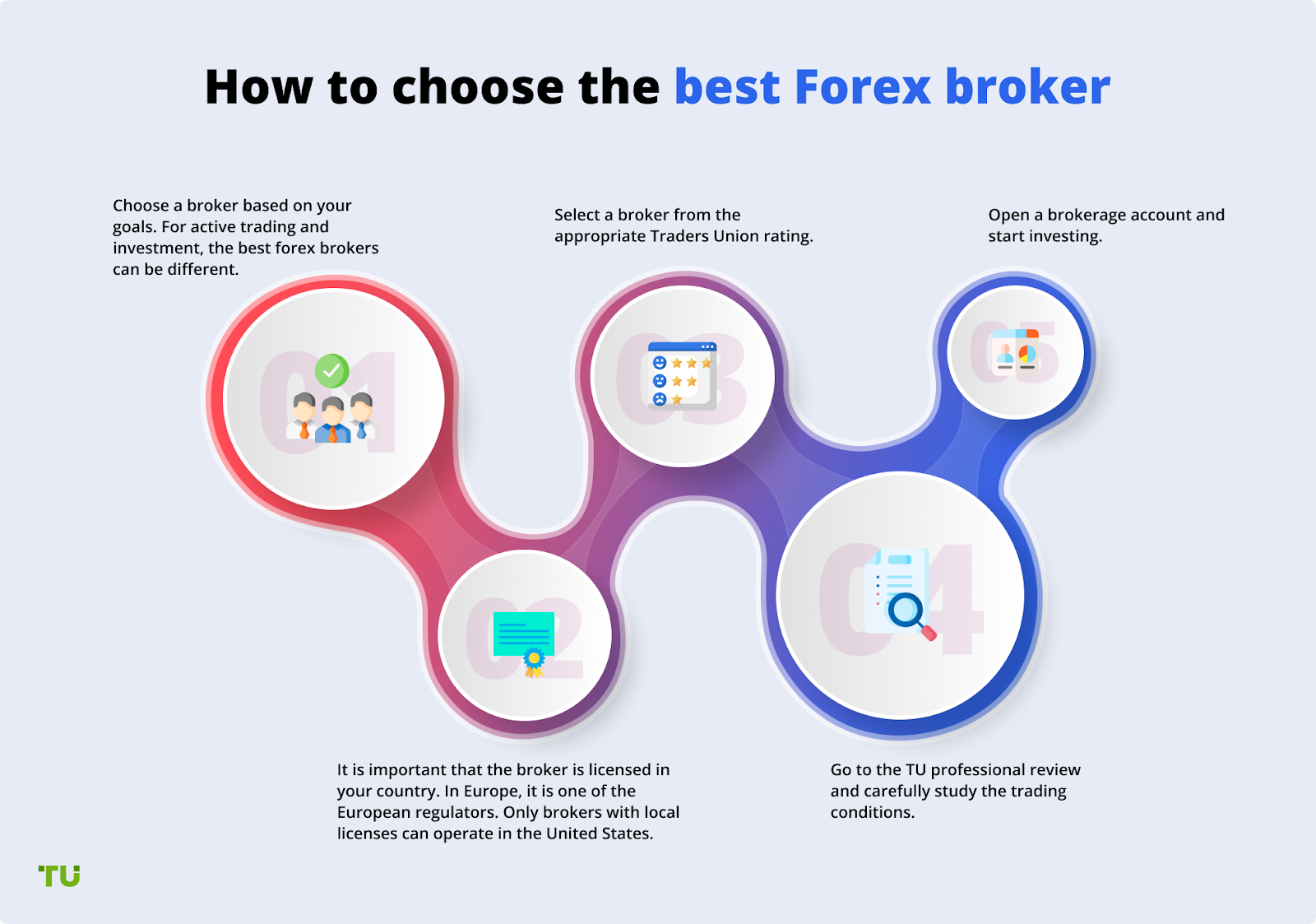

Choosing a Forex Broker

When choosing a forex broker, knowing how you want to invest and what possible outcomes you expect from it is critical. Moreover, understanding the intricacies of currency pairs and market dynamics is vital, as these can significantly impact your trading outcomes. Expert insights into these aspects can be incredibly beneficial for both new and seasoned traders. Therefore, anyone who wants to learn how to trade forex must answer the following questions when choosing a Forex broker:

- What is your investment style, i.e., what type of investor do you consider yourself?

- Have you reconsidered the goals you want to achieve with your investment?

- What level of security is provided by your broker company?

Here are some essential tips for choosing the right Forex broker for your investments.

1. Check Compliance with Regulatory Authorities

A compliance check is the first indicator of a Forex broker’s reputation. If you’re learning to trade forex in the United States, make sure your Forex broker is a National Futures Association (NFA) member.

Instead of being attracted to intriguing offers and flashy websites, confirming that your broker adheres to the CFTC regulations is critical. Confirming your broker adheres to CFTC regulations is critical if you want to ensure a reliable, trustworthy broker is handling your funds.

A flashy website and intriguing offers may be tempting, but they don’t tell much about how well a broker follows CFTC regulations.

Typically, reputed brokers provide their membership and compliance information in their ‘About Us section on the official website.

Once compliance is confirmed, you can safely make transactions and trust your broker with your investment.

2. Ensure Optimal Account Features

Forex traders offer a broad range of account features, and the right one for you depends on your investment style. Typically, there are four major areas to consider:

- Leverage and Margin – Leverage can magnify your investment, but it can also lead to significant losses if you’re not careful. Evaluating both is crucial to crafting an investment strategy that will work for you.

- Commissions – The commission is your broker’s fee for executing a trade. While the standard practice is to pay a commission to your broker, some brokers don’t earn revenue from commissions – they make their money by charging wider spreads between their bids and ask prices. The best way to determine whether a broker is suitable for you is to understand how that brokerage firm makes money.

- Initial Deposit Limits – Some brokers require investors to start their accounts at little deposit value. Some brokers may also provide no initial deposit, attracting potential investors who may not know how to trade forex. A red flag that most people should look out for is brokers who are not transparent about their policies and practices.

3. Currency Pairs Offered by the Broker

Forex brokers must have multiple foreign currencies available for trading. These will vary from one broker to another and will include some of the most popular foreign currencies such as USD/JPY, EUR/GBP, GBP/CHF, and USD/CAD.

If you’re interested in trading currencies that aren’t available on your broker’s platform, they may be able to provide them through affiliated brokers.

4. Trading Platform Features

The platform is the software you use to execute trades, which can make or break your experience as a trader. It’s important to choose a platform with features that suit your needs and preferences but also one that has been tested by other traders and deemed trustworthy. Some things to look out for are:

- Does the platform offer chart tools? You’ll want to see trends in currency prices over time, which will help you decide when to buy or sell currencies.

- What kinds of indicators does the platform offer? Indicators are tools that tell us where price trends are going or whether they’re likely to change direction soon. They come in different shapes and sizes—some are only useful for short-term predictions, while others can also give us insight into long-term trends.

- Are there any other tools included with the trading platform? For example, many brokers will include news feeds so that their users can stay up-to-date on current events affecting global markets.

Conclusion:)

Choosing the right forex broker is something only you can decide. However, we hope that our guide has provided you with enough information to make a smart decision. And remember—as always—do your research! Reading reviews and considering other people’s opinions will help keep you on the right track.

Read also:)

- How to Use a Forex Compounding Calculator: A-to-Z Guide for Beginners!

- Top 10 best forex brokers In the world: Check Forex brokers list!

- 5+ Best Trading Platform for Beginners: The Beginner’s Guide!

So hope you liked this article on How to Choose a Forex Broker? And if you still have any questions or suggestions related to this, then you can tell us in the comment box below. And thank you so much for reading this article.